Taptap Send receives a temporal halt in Ghana over their cedi remittance wallet

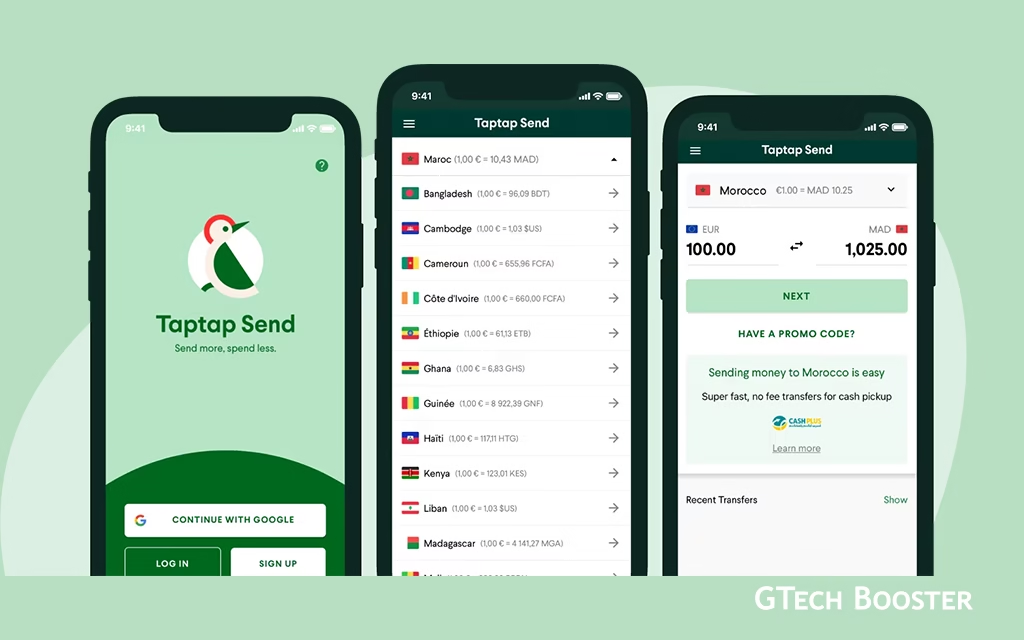

Taptap Send is a mobile application designed to facilitate fast and secure international money transfers, primarily targeting diaspora communities.

Taptap Send is a mobile application designed to facilitate fast and secure international money transfers, primarily targeting diaspora communities. Taptap Send allows users to send money abroad quickly and at competitive exchange rates directly from their smartphones. The process is simple—users can transfer funds using just a few taps, making it convenient for sending money to family and friends in various countries.

Transfers are typically completed within minutes, and the service is backed by bank-level security measures. Taptap Send ensures that there are no hidden fees, providing transparency throughout the transaction process. The company is licensed in multiple regions, including the UK, US, Canada, UAE, and the EU, which adds to its credibility and reliability.

The app primarily serves users sending money to Africa, Asia, the Caribbean, and Latin America. It supports various currencies and offers options such as mobile money transfers, cash pickups, and bank transfers.

The Mishap

Recently, Taptap Send faced regulatory challenges in Ghana. The Bank of Ghana suspended its remittance services for one month due to violations related to its cedi remittance wallet operations. This suspension highlights the importance of compliance with local financial regulations, particularly concerning foreign exchange transactions.

The BoG’s decision follows a breach of specific regulatory guidelines under the Foreign Exchange Act, 2006 (Act 723) and the Updated Guidelines for Inward Remittance Services for Payment Service Providers. Taptap Send’s operational model reportedly involved a cedi-denominated remittance wallet, which the Bank of Ghana cites as a contravention of local exchange regulations. The Foreign Exchange Act explicitly prohibits conducting foreign exchange business without appropriate licensing under section 3(1).

The central bank highlighted further compliance issues in its notification, underscoring that Taptap Send’s partnerships did not adhere to guidelines regarding local settlement accounts and anti-money laundering (AML) requirements. As outlined, remittance service providers must transfer remittance funds to beneficiaries within 24 hours and avoid non-compliant transactions, ensuring they meet all AML obligations for settlements.

The directive, issued on 31st of October , 2024, mandates the temporary cessation of Taptap Send’s partnerships with Enhanced Payment Service Providers (EPSPs) and commercial banks across Ghana, starting 8th of November, 2024. The cessation expires on the 8th of December, 2024.

Taptap Send emphasizes its commitment to diaspora communities by providing a service that addresses their specific financial needs. The company aims to reduce costs and delays typically associated with international money transfers.

User Experience

Users have reported positive experiences with Taptap Send, citing its ease of use, competitive rates, and quick transfer times. The app has garnered a reputation for being user-friendly, making it an appealing choice for individuals looking to send money internationally without hassle.

Taptap Send stands out in the remittance market by focusing on speed, security, and community engagement. Despite facing recent regulatory challenges in Ghana, its commitment to providing affordable and efficient money transfer services continues to resonate with users worldwide. For anyone looking to send money abroad conveniently, Taptap Send remains a noteworthy option.